By Jarkko Konttinen, independent consultant and former Vice President Marketing, CX and Ancillary Business, Finnair

New technology and advanced customer intelligence enable new opportunities for expanding and improving retail business in air travel. Airlines have extensive customer knowledge and a captive audience that, enabled by digital applications, can be stimulated with smart and entertaining in-flight retail opportunities utilising emotional momentum, but they suffer from poor, expensive and limited delivery. While airport retailers excel in inexpensive logistics, they are competing for the attention of busy and nervous customers, with limited customer intelligence. What if the retail business model for air travel could be more (or fully) integrated into an ecosystem combining the best of both worlds?

New emerging retail opportunities in air travel

Airlines are becoming better retailers, but they are still on a learning curve. Recent IdeaWorks estimates indicate that airlines generated close to $70 billion in ancillary revenues last year. Ancillary sales usually represent only a small portion of an airline’s turnover. However, we have seen that it is an area that is growing considerably every year.

This growth has attracted the attention of airline CEOs as simple, and traditionally volatile, flight ticket sales have only occasionally generated profits when they are helped by external factors. Airlines generate ancillary revenue through multiple streams of travel-related products (like baggage, pre-reserved seats and upgrades), third-party products and services (commission-based sales of hotels, car rentals and insurance), frequent flyer commercial partnerships (mainly credit card co-operations), travel retail sales, travel products (like stopovers and holiday packages), and booking-related services.

Currently, the majority of ancillary revenues are generated by flight-related products and frequent flyer programmes, but there has been more focus on digital multi-channel retailing of goods and services, and bundled price products. Airlines, with all of their business functions and IT infrastructure, have, however, been built to sell flights from their foundation. In many cases, the retailing aspects have faced organisational challenges as the current sales and marketing processes are built around optimising flight ticket sales, while efficient retailing requires a multi-channel approach throughout the customer journey. Most airlines are still on a learning curve when it comes to retail opportunities, but with new external recruits who might have retail experience, and smarter overall operations, airlines will inevitably improve their retail performance in the coming years. Retailing margins and big data utilisation will also impact basic flight sales when smart revenue management operations shift their focus on optimising flight revenues to optimising total customer value.

Experiences over physical products

As new retail opportunities emerge for airlines, there will surely be wider interest and increased hype surrounding the topic. Every dollar earned through enhanced retail business opportunities will be a direct result of multiple activities and hard work. Expanding retail options will require airlines to make strategic choices. There will be some airlines that will definitely focus on their own fully controlled operations, and some will search for partner models with sales commissions. One alternative could also be to rent virtual retail space inside the in-flight entertainment system to third party retail providers or external retail operators.

Modern air travellers are time-constrained and search for a more personalised experience. When I was at Finnair, we saw a shift in consumer behaviour that has affected air travel and retail. Individual empowerment has shifted to consumers, and they look for more individual choices and tailored experiences. In the latter case, this means people increasingly value experiences over physical products. In the customer journey, this should all be served in a simple manner and a functional way through proactive and predictive digital applications. In travel retail, we have seen the rise of local brands into airports and into the portfolio of airline merchandising. This has given a more local flavour to airlines and has been a differentiating factor for those that have done it well. There is a clear shift in air travel retail to offer more lifestyle products and services instead of the traditional bulky tax-free selection.

Retailing via in-flight Wi-Fi

Retailing improves the customer experience during air travel. According to our research and customer feedback, especially among the rising Asian customer segments, air travellers have high expectations of an airline’s retail product portfolio, and they expect to have an opportunity to buy exciting and exclusive products with value. Airlines don’t fully utilise their pre-flight retail opportunities to create and manage expectations, and to create retail excitement. Onboard physical sales are restricted by procedures and flight times, and there are physical restrictions on creating live showrooms onboard a plane.

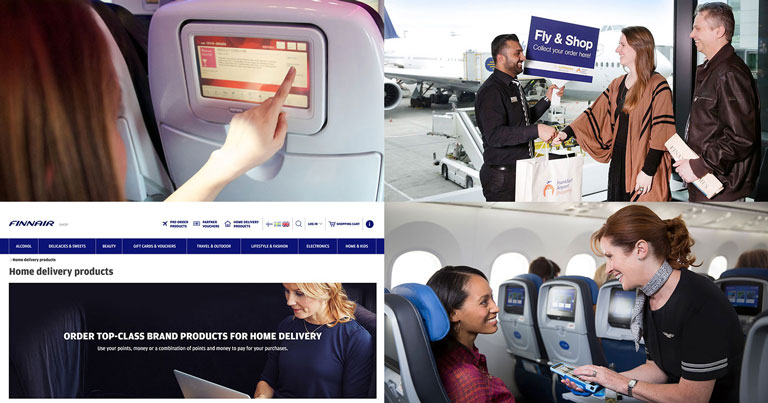

Taking the retail experience to an airline’s in-flight Wi-Fi portal, for example, offers an endless number of possibilities for products to be sold, as well as services which can be tailored to match the customer’s interests. Furthermore, there are no limitations on what can be sold onboard and then brought to the customer with home delivery. There is a competing force, however; when a customer connects to the internet on the portal, he also becomes a “lost” customer from an airline’s in-flight shopping portal. Even when sales happen more and more via digital platforms, the importance of the cabin crew in in-flight sales does not vanish – the importance of promoting and supporting digital sales onboard should be especially emphasised in their training. The same applies for ground staff at airports; they have an opportunity to guide and promote the in-flight shopping experience onboard.

Making the most of passenger data

Airlines know a lot about their customers and are improving their customer insights for future retailing. Even booking data includes simple yet important insights, which can give an indication to determine tax-free opportunities and national limitations, directional opportunity, preferred currency and payment, as well as high-level national or cultural preferences. When this data is enriched with frequent flyer data, airlines and their potential retail partners will have an even larger scope of relevant information to use when marketing to their customers.

Big data holds some privacy issues that depend on local legislation but this is an area that smart retailers are increasingly focusing on. The big question is how can this data best be utilised, by whom, and can the data be shared? On a customer’s journey, there are stakeholders who can provide better service and retail opportunities utilising this data, but there are both privacy and commercial issues, which could cause some hesitation surrounding the use of this data.

Technology enables new retail opportunities. New services like airline in-flight shopping portals and apps are built more and more to support both segment and geo-targeted sales dialogue with passengers. At the same time, these digital services enable payment platforms, removing barriers of cash currency challenges or even the ability to use local credit cards such as China’s Union Pay. Digital in-flight retail platforms don’t have special restrictions; they are fully compatible with any other online shop. But it has certain benefits in terms of its ability to sell to passengers when they have nothing else to do and, in most cases, having both family decision makers present.

Travel and destination related services are also natural items to sell, in addition to merchandising. It is easy to see how popular it could be for customers to plan and purchase services like tours, accommodation, dinners and spa treatments for their destination while they are on their flights. But also the shopping for any item, be it home or airport delivered, can be made easy. Airlines can also utilise their other in-flight touch-points to attract passengers to online sales channels and boost sales. This would include the use of seatback IFE content, in-flight collateral and crew activities. Physical in-flight showrooms have limitations but virtual reality could offer an interesting solution for this. The in-flight shopping experience needs careful planning and maintenance with solid business cases. Shop-in-shop solutions can also offer consumer brands an international presence and an opportunity to engage customers with strong storytelling, in addition to sales, of course.

New airline-airport retail opportunities

This leads into new business models and the interesting study of new retail opportunities. Besides customer knowledge and insights, airlines have truly captive media. Enabled and boosted by new in-flight portals, the simple calculations multiply “retail influential time” to numbers that many retailers can only dream of with the right emotional moment. It’s no wonder that some global retail players and airports have indicated their interest towards the trend of digital in-flight retail.

Despite this, many airlines don’t utilise the maximum potential of all retail opportunities. Today’s customers are more and more constrained by time, and retailers with a captive audience have strong assets. If this retail opportunity is even enriched with customer data, the business is built for success. In this retail formula, airlines are, however, missing the important logistics due to limited airborne warehouse space, or at least it comes with expensive costs. When a plane is airborne, every kilogram of useless weight counts on the airline’s bottom line. I can only imagine the financial impact if someone could count the fuel costs of all the unsold retail items that are not matching demand in quality or quantity.

Airports, on the other hand, are built like shopping malls with great logistics. But at the same time, most passengers feel that airports are major causes of stress and inconvenience. Customers are in a hurry, or they are feeling stressed and under time pressure. If you have time to spare, shops are great, but how can a customer be really interested in buying a product that really matches his or her needs?

Buy onboard and pick up at the airport

Airlines and airports could form a comprehensive, and effective, jointly managed retail process with clear economies of scale and retail efficiencies. The value proposition for customers is clear, as you can order onboard whatever you can carry with you, with instant delivery at the airport, either in shops or delivered to your next flight. Shopping is not only limited to onboard arriving and connecting flights; it can also be done at home, boosted by airlines’ pre-departure messaging. Products sold onboard don’t have to be limited to the retailers working at the airport. For example, with effective courier services, any retailer within a few hours’ reach of the airport can deliver their products to the airport for customers to pick up, even with tax-free prices if applicable.

This would enable new business opportunities for airports. If you set clear roles in the retail process, it would greatly improve the customer experience and offer a unique value proposition: you can choose and buy a wide selection of targeted and inspirational products onboard with instant ground delivery. Airlines have an opportunity to utilise their sales dialogue with customers before, during and after the flight, assuming that customers have given their approval for this.

Business models are naturally challenging

If airlines could manage the retail marketing and sales aspects, and airports could focus on the delivery, business models would need to be adjusted to match the airport and airline’s roles in this new retail process. Commission-based sales are familiar for airlines on many third party ancillary products, so there should not be any special barriers to this approach. One improvement area could be for airport retailers and airlines to optimise the use of frequent flyer miles or points as currency. From a customer’s point of view, this would form a better-integrated customer journey.

There are multiple baby step opportunities. Airports and airlines can form joint theme calendars and promotions, creating an integrated retail experience. Joint mobile apps would provide easy-to-use solutions to increase sales. When airlines are focusing on ancillary products, airports will also have new opportunities to market and sell the ancillary services offered by the airlines on the ground. No matter what angle you look at this from, the future of integrally managing the customer retail experience makes perfect sense for airlines and the airports where they operate.

As stated earlier, we expect the desire for airlines to increase their retail opportunities to be a significant trend in the airline industry over the next couple of years. The co-operation between airlines and airports will be critical here as there is plenty of room for creative and innovative retail processes, which can be developed together by both parties for the benefit of travelling customers. Airlines that have expanded their horizons and ventured into these new business models relating to the retail sector will be in a very good position to reap the financial benefits in the short and long term.